Management Policy Corporate Governance

▼Basic approach ▼Overview of our corporate governance structure

▼Composition, purposes, and roles of committees and conference bodies ▼Corporate Governance Report

▼Skills Matrix of Directors ▼Policy and procedure for nomination, election and dismissal of Directors ▼Evaluation of effectiveness of the Board of Directors ▼Directors’ compensation ▼Basic Views on Internal Control System ▼Steps for the strengthening of governance

Basic approach

To meet the expectations of shareholders, business partners, employees, and other stakeholders and to enhance our corporate value, we recognize enhancement of our corporate governance structure as a vital issue in management and strive to practice transparent, fair, and efficient management.

Under this policy, we have established a basic framework and policy for corporate governance and, to achieve sustainable growth and enhance corporate value through the practice of governance, have established and operate our Corporate Governance Guidelines.

Overview of our corporate governance structure

By selecting the form of a company with an audit and supervisory committee and establishing an Audit and Supervisory Committee composed of a majority of outside directors, we are working to strengthen our management supervisory functions and to enhance efficiency and mobility by delegating a considerable part of authority over business execution to directors.

| Type of system | Company with Audit and Supervisory Committee |

|---|---|

| Number of directors (Of which, number of outside directors) |

9(4) |

| The term of office of directors (excluding those serving as audit and supervisory committee member) |

1 year |

| The term of office of audit and supervisory committee member |

2 years |

| Adoption of an Executive Officer System | Yes |

| Voluntary committees | Management Committee, Nomination and Compensation Committee, Internal Control Committee, Sustainability Committee |

| Independent external auditor | Ernst & Young ShinNihon LLC |

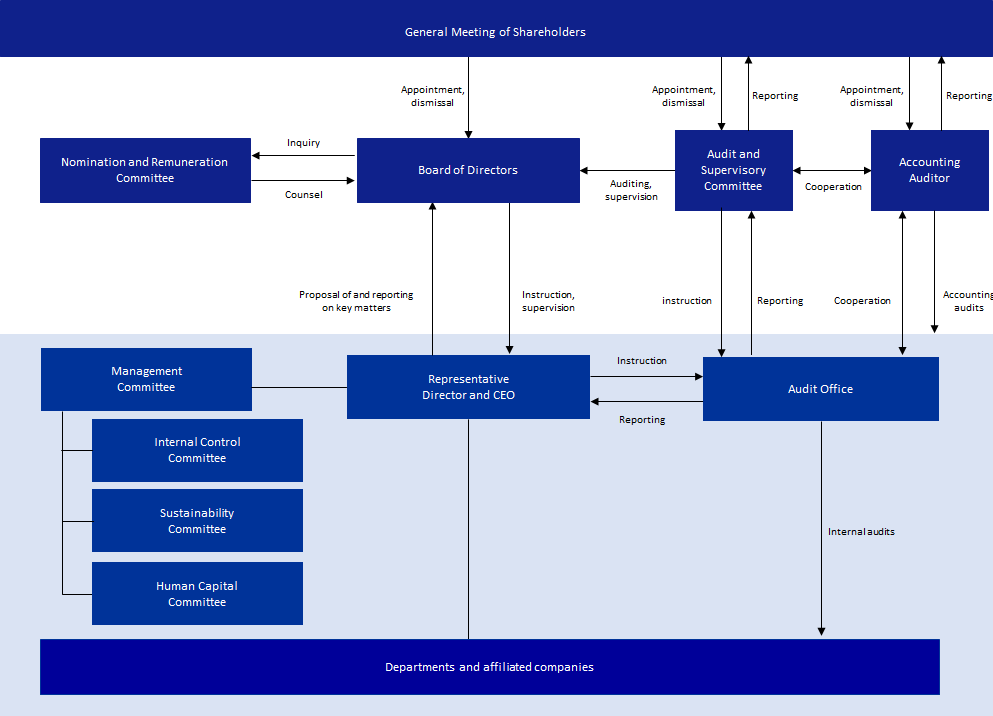

Corporate governance structure diagram

Composition, purposes, and roles of committees and conference bodies

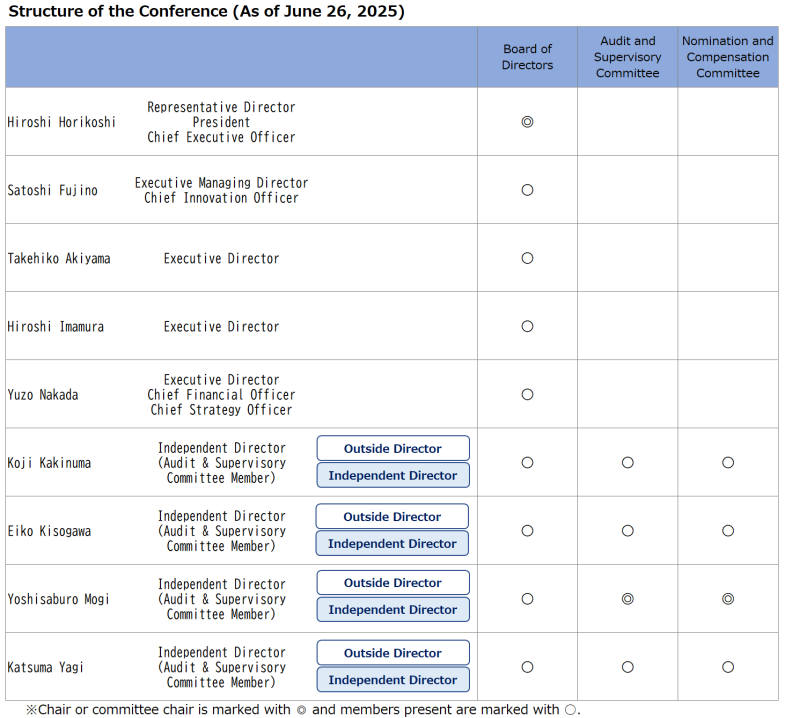

| Board of Directors | Marubun’s Board of Directors consists of nine directors, including four Audit and Supervisory Committee members who are outside directors. The Board convenes once a month in principle and whenever necessary to engage in supervision of business execution and in deliberation and decision-making on matters stipulated in laws, regulations, and our Articles of Incorporation, as well as key matters concerning management stipulated in the Board of Directors Regulations. |

|---|---|

| Audit and Supervisory Committee | The Audit and Supervisory Committee consists of four Audit and Supervisory Committee members who are outside directors. In principle, the committee convenes at least once every three months and whenever necessary. In addition to auditing the status of the execution of directors’ duties, it is responsible for the work of auditing financial and other documents and preparing audit reports. In line with auditing policies and plans determined by the Audit and Supervisory Committee, the committee conducts audits in cooperation with the Internal Audit Division and the accounting auditor. |

| Nomination and Compensation Committee | The Nomination and Compensation Committee consists of four Audit and Supervisory Committee members who are outside directors. In principle, the committee meets once a year and whenever necessary. To ensure transparency and fairness in personnel and compensation matters concerning directors, it deliberates and provides counsel on succession planning, the framework for the total of directors’ compensation, the structure and method of calculation of directors’ compensation, and the appointment and dismissal of directors with diversity and skills taken into account. |

| Management Committee | The Management Committee consists of five executive directors, including the CEO. It meets once a month in principle and whenever necessary to consider basic management policies, management plans, and other important management matters, and to deliberate in advance on matters to be resolved by the Board of Directors. |

| Internal Control Committee | The Internal Control Committee consists of five executive directors and five heads of divisions involved in internal control. The committee meets once every two months in principle and whenever necessary to monitor the development and operation of the internal control system. The Audit and Supervisory Committee receives regular reporting on the status of the internal control system from the General Manager of the Audit Office (a constituent member) via the Director of the Audit and Supervisory Committee Secretariat. |

| Sustainability Committee | The Sustainability Committee consists of five executive directors and four heads of divisions involved in sustainability activities. The committee meets once every six months in principle and whenever necessary to set policies and targets for sustainability activities and to monitor their operation. |

| Human Capital Committee | The Human Capital Committee consists of five executive directors and three heads of divisions. It meets once every two months in principle and whenever necessary to discuss, supervise, and monitor matters related to human capital management and to support the promotion of related measures. |

Corporate Governance Report

Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Disclosure based on the Corporate Governance Code

Japan’s Corporate Governance Code is a guideline summarizing the nature of corporate governance for listed companies in the form of principles. MARUBUN discloses information about matters required to be disclosed in accordance with this Code as follows.

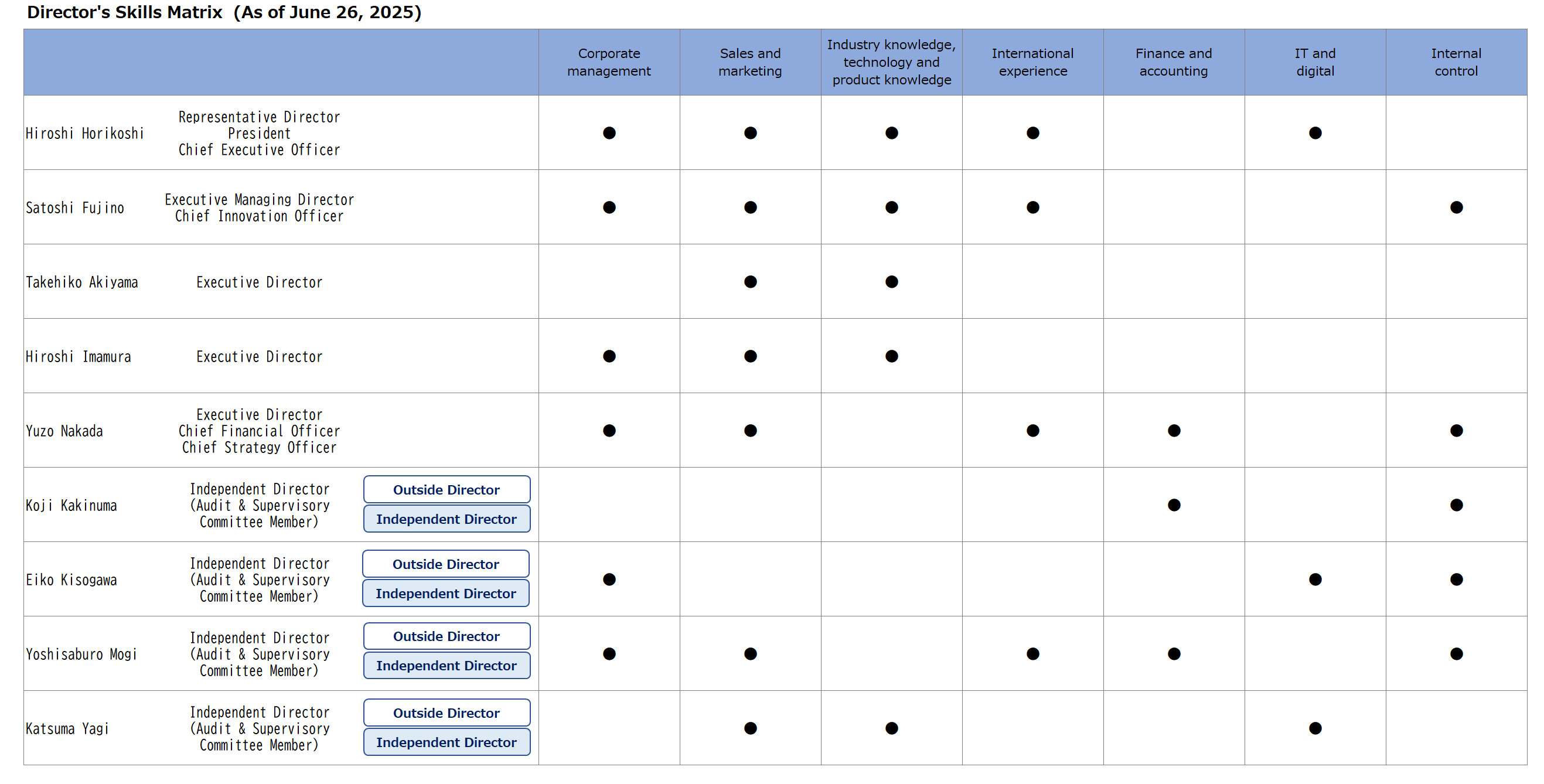

Skills Matrix of Directors

The composition of the Board of Directors and the areas of expertise and experience of individual directors, are as follows.

Policy and procedure for nomination, election and dismissal of Directors

Basic policies and procedures

The Company selects Director candidates who will contribute to the sustainable growth of the Company and the enhancement of its corporate value in the medium and long term under the selection criteria set out by the Board of Directors, comprehensively considering their personality, insight, capabilities, experience, track record and other factors. If a Director materially breaches laws, regulations or the Article of Incorporation or if it becomes clear that a Director does not meet the selection criteria, the Company shall consider dismissing them.

The Board of Directors shall propose to the General Meeting of Shareholders the election or dismissal of Directors after receiving advice and consent from the Nomination and Compensation Committee.Reason for Appointment as Directors

Please see below for the reasons for the appointment of directors.

Criteria for independence of Outside Directors

The Company has established the criteria for independence under Article 436-2 of the Securities Listing Regulations of the Tokyo Stock Exchange to ensure the independence of the Outside Directors. If the Outside Directors meet the criteria, the Company will deem them independent of the Company.

(Criteria for independence)

1.An Outside Director has not been an executive of the Company or its subsidiaries (hereinafter the “Group”) in the past ten years

2.None of the following items apply to the Outside Director within the past three years:

(i) Engaged in operations of a company that deals with the Group and accounts for more than 2% of the Company’s annual consolidated sales

(ii) Been an executive of a company that deals with the Group and whose annual sales to the Group account for more than 2% of the company’s annual consolidated sales

(iii) Been an executive of a financial institution from which the Group borrows an amount of money that is more than 2% of the Company’s consolidated total assets at the end of the latest fiscal year

(iv) Been a professional, such as a lawyer, certified public accountant, tax accountant or consultant, who receives more than 10 million yen annually in cash or other property other than officers’ remuneration from the Group

(v) Been a major shareholder of the Company (holding 10% or more of the total voting rights) or an executive of a major shareholder

(vi) Been an executive of an organization that has received a donation of more than 10 million yen annually from the Group

(vii) Been an executive of a company that exchanges officers with the Group

(viii) Been the spouse or a relative within the second degree of kinship of a person who is described in any of the items (i) to (vii) (limited to executive directors, executive officers, corporate officers or executives at the level of department head or higher)

3.In the past five years, the Outside Director has not been the spouse or a relative within the second degree of kinship of a person who has been an executive director, a corporate officer or an executive at the level of department head or higher.

Evaluation of effectiveness of the Board of Directors

To ensure that the Board of Directors properly carries out its roles and responsibilities, every year we conduct an effectiveness evaluation aimed at identifying issues and areas for improvement of the Board of Directors and at enhancing its effectiveness.

Our evaluation of the effectiveness of the Board of Directors in FY2024 was as follows.

Evaluation items and processes

Concerning our evaluation of the effectiveness of Board of Directors overall, we requested responses in writing by all directors to questions concerning (1) the size and composition of the Board of Directors, (2) the operational status of the Board of Directors, (3) the support structure for the Board of Directors, (4) the roles and responsibilities of directors, and (5) the operation of the Nomination and Compensation Committee. To enable quantitative and qualitative evaluation, we conducted self-evaluations combining a five-point-scale questionnaire format and free entry fields, and held discussions with the Board of Directors based on the tabulation and analysis results.

Evaluation results

Ratings of the effectiveness of the Board of Directors in the questionnaire were generally high, and we confirmed that our Board of Directors functions properly overall and that its effectiveness is ensured. In particular, the size and composition of the Board of Directors, the frequency of meetings, prior notification of the annual schedule and agenda items, regular reporting on sustainability and risk management and exchanges of information among outside directors were positively rated as appropriate. On the other hand, we shared the need for further improvement in the discussion on the development of director candidates from a medium- to long-term perspective and the composition of the Board of Directors, the explanation of the review process regarding Board resolutions to outside directors, and training for directors.

We will continue working to further energize and enrich discussions at the Board of Directors.

Directors’ compensation

Compensation, etc. for directors (excluding directors who are Audit and Supervisory Committee members) is set appropriately for the responsibilities and roles of directors engaged in the execution of business, and is of a content and a level that contributes to the enhancement of corporate value and performance not only in the short term but also in the medium and long term. Compensation amounts are determined within the scopeof compensation resolved at General Meetings of Shareholders, taking into account position and content of work, expected degree of contribution during the target period, consolidated performance, and other factors. The framework for the total amount of compensation, compensation structure, and calculation method are determined by the Board of Directors after obtaining advice and consent from the Nomination and Compensation Committee, which is composed of outside directors.

Compensation for individual directors (excluding directors who are Audit and Supervisory Committee members) is determined by the Representative Director and CEO, appointed to do so by resolution of the Board of Directors, after obtaining advice and consent from the Nomination and Compensation Committee. Determination of the number of restricted shares allotted as compensation to individuals will be determined by resolution of the Board of Directors.

Compensation for directors who are Audit and Supervisory Committee members will be decided through deliberation at said committee, taking into account the content of the directors’ duties and other factors from a perspective of ensuring independence and neutrality and within the compensation framework resolved at General Meetings of Shareholders. The total amount of compensation, etc., the total amount by type of compensation, etc., and the number of eligible officers for each category of officer in FY2024 are as follows.

|

Officer category |

Total amount of compensation, etc. |

Total amount of compensation, etc. (million yen) |

Number of eligible officers |

|||

|

Fixed compensation |

Performancelinked compensation |

Retirement benefits |

Of item at left, non monetary compensation |

|||

|

Directors (excluding Audit and Supervisory Committee members |

180 |

122 |

57 |

– |

17 |

5 |

|

Directors (Audit and Supervisory Committee members |

– |

– |

– |

– |

– |

– |

|

Outside directors |

36 |

36 |

– |

– |

– |

4 |

Note: Total amount of Compensation, etc. for directors does not include the salaries of employees who concurrently serve as directors.

Remuneration system

Remuneration for the Company’s officers is based on their job positions, specifically their roles, authorities and responsibilities.

Remuneration for Directors (excluding Directors who are members of the Audit & Supervisory Committee) is comprised of fixed remuneration (base pay and position-based pay), performance-linked remuneration (performance-based pay), and stock-based compensation (restricted stock-based compensation). Directors who are members of the Audit & Supervisory Committee only receive fixed remuneration (base pay).

Out of the fixed remuneration, base pay is the basic remuneration determined by position, with officers holding the same positions receiving the same base pay, which shall be revised according to trends in the price of goods. Position-based pay received by each officer shall be based on the duties assigned to them.

Performance-linked remuneration (performance-based pay) is calculated using the Company’s results in the previous fiscal year and coefficients determined by officer type.

Stock-based compensation (restricted stock-based compensation) is intended for officers to share the advantages and risks of changes in the stock price with the shareholders and to increase the officers’ motivation to contribute to raising the stock price and enhancing corporate value. The Company shall grant a calculated certain percentage of performance-based pay as stock compensation. The eligible Directors shall make in-kind contributions for all the monetary claims, and in return shall receive common shares of the Company. The eligible Directors may not transfer, create a security interest on, or otherwise dispose of the common stock during a specified period. The Company shall acquire the shares without consideration in certain circumstances.

The percentage of Directors’ total remuneration that is performance-based compensation varies according to the results of the Company. The Company uses consolidated ordinary income, which reflects foreign exchange gains and losses, as an indicator in the calculation of performance-based compensation because foreign currencies account for a large percentage of the Company’s transactions.

The target for consolidated ordinary income, the calculation basis for performance-based compensation, in the fiscal year ended March 31, 2024 was 5,000 million yen. Actual consolidated ordinary income was 5,627 million yen.

Resolution of the General Meeting of Shareholders on remuneration for officers and others

The 68th General Meeting of Shareholders held on June 26, 2015 resolved to grant remuneration of 400 million yen or less annually to Directors (excluding Directors who are members of the Audit & Supervisory Committee) (this remuneration does not include their salaries as employees; the number of Directors set out in the Articles of Incorporation is ten or fewer, and the number as of the date of submission of the securities report was five).

At the 76th General Meeting of Shareholders held on June 28, 2023, the Company resolved to introduce a restricted stock-based compensation plan and grant monetary claims of 50 million yen or less annually to grant restricted stock-based compensation to Directors (excluding Directors who are members of the Audit & Supervisory Committee and Outside Directors) within the above limit. The resolution also stipulates that the total annual number of common shares of the Company that are issued or disposed of shall be a maximum of 100,000. Furthermore, at the 78th Ordinary General Meeting of Shareholders held on June 26, 2025, the Company received approval to revise the total amount of monetary compensation claims for the grant of restricted stock to the Eligible Directors to an annual amount of no more than 100 million yen.

The Company’s 68th General Meeting of Shareholders held on June 26, 2015 adopted a resolution to set the limit of remuneration for Directors who are members of the Audit & Supervisory Committee at 100 million yen per year (the number of Directors who are members of the Audit & Supervisory Committee set out in the Articles of Incorporation is five or fewer, and the number as of the date of submission of the securities report was four).

Activities conducted by the Nomination and Compensation Committee and the Board of Directors in the process of deciding the amount of officers' remuneration and other matters

Activities conducted by the Nomination and Compensation Committee and the Board of Directors in the process of deciding the amount of officers’ remuneration, among other matters, for the FY2024 are as follows.

(Nomination and Compensation Committee)

The Nomination and Compensation Committee held three meetings in the FY2024. It was requested that the committee discuss the allocation of remuneration to individual Directors and the parsonnel evaluation and provided advice.

(Board of Directors)

At a meeting held on June 26, 2024, the Board of Directors adopted a resolution about the remuneration for Directors (excluding Directors who are members of the Audit & Supervisory Committee) for the FY2024.

Basic Views on Internal Control System

MARUBUN CORPORATION (“the Company”) has formulated and applies its “Basic Policy on Establishing Internal Control Systems,” as follows.

Steps for the strengthening of governance

To enhance our corporate governance structure, we have undertaken the following initiatives.

| FY2012 | Introduction of an corporate officer system |

|---|---|

| FY2013 | Migration to the structure of a company with an audit and supervisory committee |

| FY2014 | Establishment of the Corporate Governance Guidelines |

| FY2015 | Establishment of criteria for determination of the independence of outside directors |

| Establishment of a personnel advisory council (currently the Nomination and Compensation Committee) | |

| FY2016 | Start of effectiveness evaluations of the Board of Directors |

| FY2021 | Establishment of the Sustainability Committee |

| FY2022 | Disclosure of Skill Matrix for directors |

| FY2023 | Increase in number of outside directors (from 3 to 4) |

| First appointment of a female outside director | |

| Introduction of a restricted stock compensation plan | |

| FY2024 | Establishment of the Human Capital Committee |